Uber Technologies, Inc. showcased a staggering performance in its first quarter of 2025, surpassing its earnings expectations yet falling short of projected revenue growth. This combination of results shed light on the company’s complex fiscal landscape. Specifically, Uber reported earnings of 83 cents per share, significantly beating analyst predictions that anticipated only 50 cents. However, the stock felt the market’s discontent, retreating approximately 5% following the announcement of their $11.53 billion revenue, which was slightly below the expected $11.62 billion.

This juxtaposition presents a classic case of investor psychology: strong earnings can often be obliterated by revenue disappointments, despite the undeniable improvement in overall financial stability. Overall, revenue saw a heartening growth of about 14% compared to the same timeframe the previous year, illustrating the company’s ability to rebound from a staggering net loss of $654 million a year prior. This transformation into net income of around $1.78 billion portrays Uber’s resilience in a competitive market.

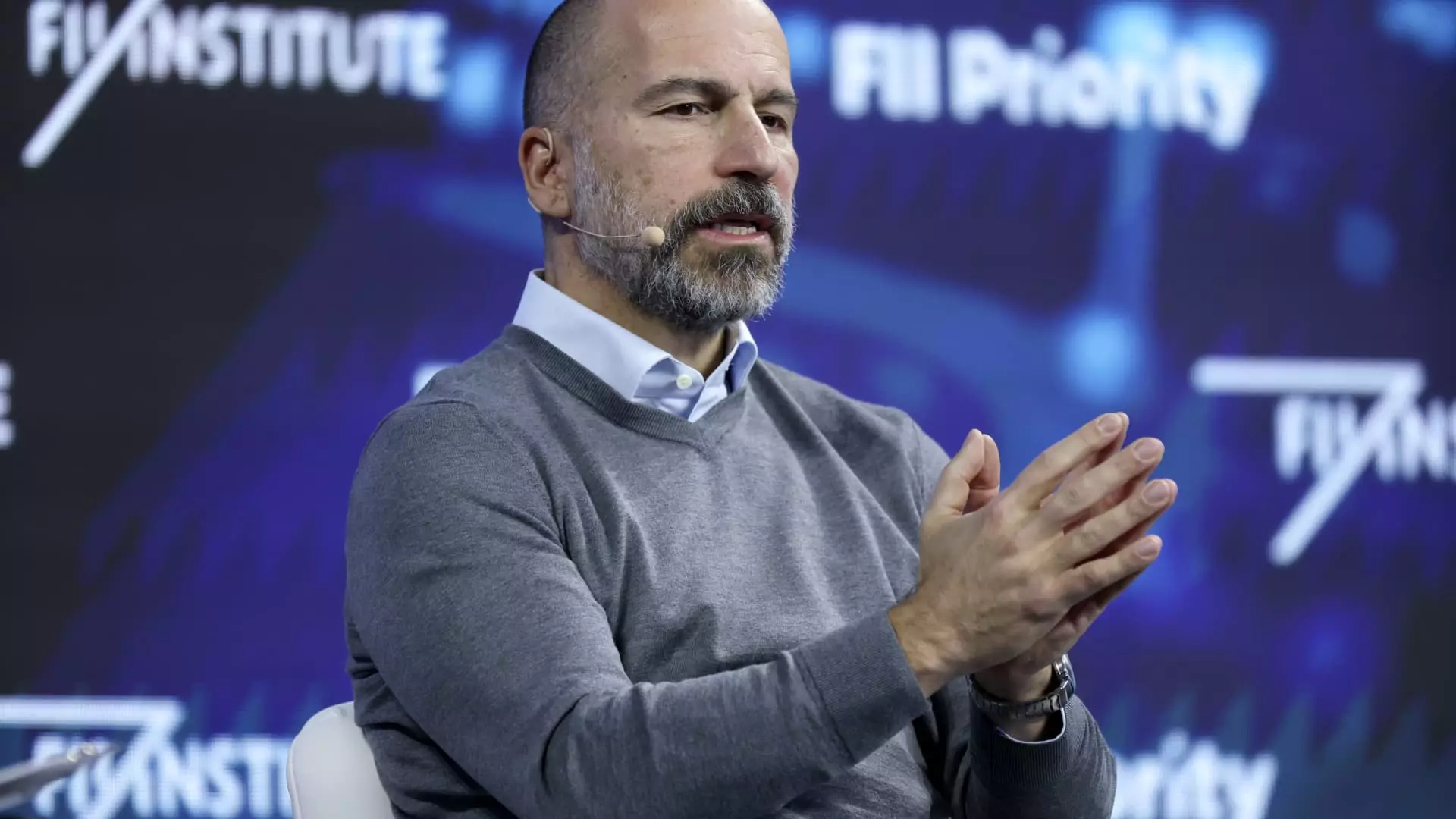

CEO Insights and Strategic Expectations

Uber’s CEO Dara Khosrowshahi and CFO Prashanth Mahendra-Rajah have set ambitious goals for the upcoming quarter, projecting gross bookings between $45.75 billion and $47.25 billion. Such optimism reflects a strategic vision aimed at catalyzing continued growth in a market that seems increasingly saturated. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) are expected to range between $2.02 billion and $2.12 billion.

Khosrowshahi’s faith in Uber’s growth trajectory comes amidst external challenges, such as the lawsuit filed by the Federal Trade Commission, which is scrutinizing the company’s Uber One subscription service for alleged deceptive billing practices. Interestingly, Khosrowshahi defended the service’s simplicity, urging critics to explore it firsthand. He highlighted that a robust 60% of gross bookings from Uber Eats stem from Uber One members, indicating strong consumer engagement and loyalty.

The Changing Dynamics Of Its Business Segments

Analyzing Uber’s business segments reveals a positive trend in both ride-hailing and delivery services. For the first quarter, the gross bookings from Mobility reached $21.18 billion, reflecting a year-over-year increase of 13%, while Delivery surged to $20.38 billion, marking a 15% rise. This indicates not just recovery but potential expansion into new markets or enhanced consumer trust in the service offerings. The growth is further emphasized by the rise in monthly active platform consumers, which increased to 170 million—a significant 14% year-over-year fine-tuning.

Furthermore, the increase in trip bookings, hitting 3.04 billion in the first quarter, translates to an 18% jump from the previous year, showcasing an avid appetite for the service. This raises key questions around user acquisition strategies and operational efficiency in a competitive digital marketplace where consumer loyalty is paramount.

Controversies and Workforce Dynamics

Despite the robust financial performance, Uber faces growing scrutiny regarding its workforce policies. Recently, the company has mandated a return to the office policy that requires employees to work on-site three days a week instead of two. While this move is allegedly designed to enhance collaboration and creativity, it has sparked internal controversy. Khosrowshahi defended the decision, claiming that exceptional performance necessitates a cohesive environment where employees can collaborate in person.

The company has also revised its sabbatical policy, increasing the tenure required for eligibility from five to eight years. Such changes can be a double-edged sword: while they may streamline operations, they also risk alienating employees who value flexibility and work-life balance. This evolving corporate culture could be met with skepticism and decreased morale, possibly affecting productivity in the long term.

Embracing the Future: Autonomous Vehicle Technology

In a forward-looking pivot, Uber is placing significant bets on the future of autonomous driving technology. Khosrowshahi has termed autonomous vehicles (AVs) as “the single greatest opportunity ahead for Uber.” Currently, the company presents robotaxi services to users in specific U.S. markets and is experimenting with AV deliveries. The company’s successful collaboration with partners like Waymo underscores its ambitious drive toward redefining urban transport scenarios.

The recent announcement that Uber reached an annual run-rate of 1.5 million autonomous vehicle trips in Austin reflects enthusiastic adoption. The outcome of utilizing Waymo vehicles has even exceeded expectations in terms of operational success. However, a sustainable shift to fully autonomous operations remains focused on regulatory hurdles, public perception, and technological reliability.

Uber’s aggressive strides in AV partnerships, along with its traditional ride-hailing and food delivery services, signal its ambition to not only recover but actively shape the industry landscape. By diversifying its offerings and enhancing operational efficiencies, Uber is crafting a narrative of resilience and innovation in a world that demands constant adaptation.

Napsat komentář