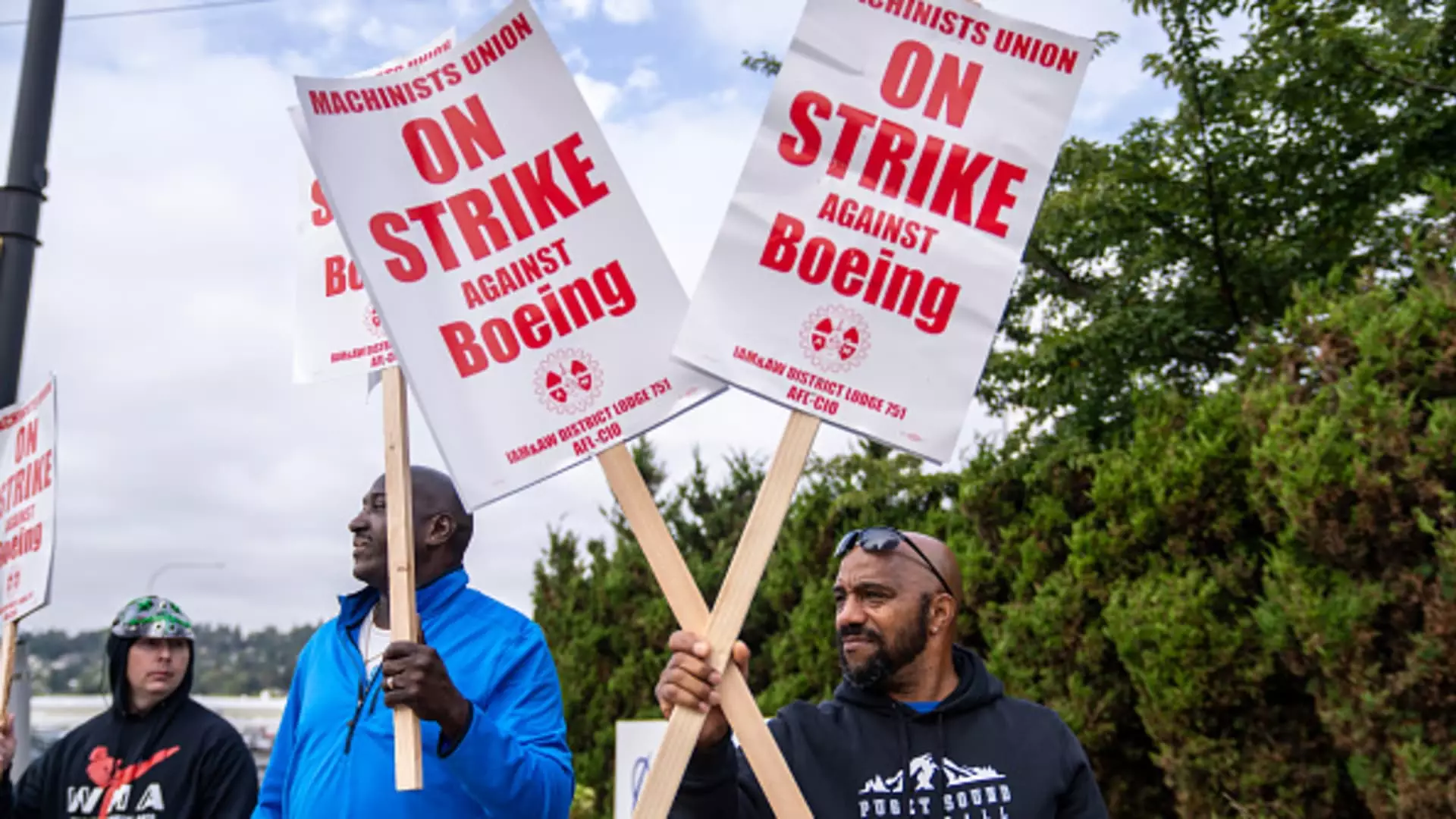

In a significant move that underscores the mounting tensions between labor and management, more than 30,000 Boeing machinists recently launched a strike after overwhelmingly rejecting a tentative contract. The event marks a critical point in Boeing’s already troubled timeline, amplifying the challenges faced by the new CEO Kelly Ortberg. As the aircraft manufacturer navigates through financial uncertainties, the ramifications of this labor dispute are poised to ripple through both the company and the broader aerospace industry.

The strike is projected to cost Boeing more than $1 billion each month, as estimated by S&P Global Ratings. This financial strain comes at a delicate juncture for the company, which has been grappling with various crises, including the fallout from dual 737 Max tragedies and recent production setbacks. The union’s decision to halt production has thrust the company deeper into a cash-flow crisis, thwarting efforts to stabilize its operations and soothe investor anxieties.

The machination of labor has powerful implications for Boeing’s bottom line, particularly when considering the costly delays in aircraft production. With the union’s ongoing strike, plants in Seattle and other areas have ground to a halt, severely impacting production capabilities. The loss of income for union members, alongside the subsequent cancellation of essential benefits, only compounds the gravity of the situation. Although the union has found temporary job opportunities for its members, the long-term outlook remains bleak without a rapid resolution.

Kelly Ortberg’s short tenure as Boeing’s CEO has become even more precarious against the backdrop of this strike. Just as optimism was building around negotiations with labor groups, the rejection of a revised contract brought reality crashing down. In recent communications, Ortberg admitted that more aggressive tactics might be necessary to stem the bleeding, even while acknowledging the struggles that have beleaguered the company since 2018—having not posted an annual profit in five years.

The failure to solidify a deal not only jeopardizes current production but could also result in escalated layoffs. Ortberg’s announcement of a potential 10% workforce reduction has sent shockwaves through the organization, indicating that the company is not just dealing with external pressures but initiating cost-cutting measures from within as well. As financial losses deepen, with projections indicating losses nearing $10 per share for the third quarter, stakeholders are understandably concerned.

Jon Holden, the president of the IAM District 751 union, remains steadfast in advocating for a return to negotiations, asserting that the membership will ultimately determine the acceptance of any potential contract offer. Adding to the complexity of negotiations, Boeing has filed for an unfair labor practice with the National Labor Relations Board, alleging bad faith on the union’s part—an assertion that complicates any dialogue moving forward.

The current standoff highlights the contrasting philosophies obstructing progress, as the union’s demand for restored pension plans clashes with the company’s strategy to control costs. Experts like Harry Katz from Cornell University suggest that a resolution may take longer than anticipated, potentially dragging on for an additional two to five weeks.

The strike and Boeing’s inability to resolve it quickly could have broader ramifications that extend beyond the company itself. Suppliers, including Spirit AeroSystems, which plays a pivotal role in manufacturing Boeing’s fuselages, may start to experience instability—echoing the repercussions from Boeing’s labor strife. As financial conditions tighten, the potential for layoffs and furloughs in the supply chain becomes a real possibility, impacting thousands of workers.

Moreover, industry analysts remain skeptical about Boeing’s trajectory amidst worsening conditions. With a projected equity raise of up to $15 billion suggested to mitigate financial strain, the path ahead appears fraught with uncertainty. Executives at Boeing must navigate an environment characterized by labor discord, quality control issues, and a dwindling reputation stemming from previous crises.

The current strike presents a critical juncture for Boeing, a company already struggling under the weight of substantial challenges. With its leadership now facing immense pressure from both investors and union members, decisions made in the coming weeks will be pivotal. The delicate balance of addressing labor needs while securing financial stability will determine whether Boeing can rebound from its current predicament or continue on a path of decline. Ultimately, how this situation is resolved will not only shape Boeing’s future but could have lasting effects on the wider aerospace industry as well.

Napsat komentář